When a “favorite guru” appears in your feed promising 20% weekly returns on a new crypto fund, a rare-watch syndicate or a pre-IPO allocation, the first question used to be: is this person legit?

Now there’s a more basic one: is this person even real?

From Bangladesh’s AI roadmap warning about deepfake risks to global regulators flagging AI-driven investment fraud, synthetic personalities are moving from political mischief into the heart of luxury and investing.

The result: for serious lifestyle investors in art, watches, cars, NFTs or whisky, deepfakes are no longer an embarrassing one-off. They are a structural attack on trust.

The scammer’s new favorite “influencer”

Recent cases give a sense of how fast this is moving:

- In India, scammers used an AI-generated video of the finance minister to push a fake crypto app, costing one victim the equivalent of tens of thousands of dollars.

- A fake “Nvidia Live” stream on YouTube used a deepfake of the CEO to promote a bogus crypto giveaway – and drew more viewers than the real investor event.

- Deepfake clips of Warren Buffett have been circulating on TikTok, using his reputation to push crypto schemes he would never touch.

- Across Australia and Europe, regulators are reporting millions lost to scams using AI-generated celebrity endorsements with promises of rapid wealth.

Regulators from Canada to US state agencies now warn explicitly about AI-enabled investment fraud, including deepfake videos and voice cloning used to sell “guaranteed” returns.

For platforms and investors, this isn’t an edge case. It’s the new baseline threat model.

Why this hits luxury & “lifestyle investing” so hard

Deepfake investment pitches are tuned to exactly where lifestyle investors spend time and money:

- Digital collectibles & NFTs – “exclusive drops” fronted by AI-generated celebrities or founders

- Watches, cars, whisky, art – fractional ownership schemes marketed by synthetic “experts” with invented track records

- Online brokerages and copy-trading – fake “pro traders” with fabricated performance history

These scams exploit three things:

- Para social trust – you feel like you “know” the influencer or brand face.

- FOMO and scarcity – “only 100 seats”, “whitelist closes in 2 hours”.

- Cross-border opacity – platform in one country, payment rails in another, shell company in a third.

In other words: exactly the conditions where affluent collectors and global platforms operate.

Visual: Red flags checklist (screenshot-ready)

Save or print this as your “Is this offer real?” card.

RED FLAGS CHECKLIST

- 🧪 Too perfect video

- No natural pauses, oddly smooth skin, slightly off lip-sync, or generic voice over a famous face.

- 🚀 Guaranteed or ultra-high returns

- “20% per week”, “no risk”, “AI bot does all the work”. These are classic fraud tells, deepfake or not.

- 🧍♂️ Big personality, tiny platform

- Massive “influencer” you’ve never seen before, pushing a brand-new, lightly documented platform.

- 🌐 Off-platform jumps

- Video on Instagram or TikTok, but the link takes you to a bare-bones site, Telegram group, or unfamiliar app.

- 🪪 No regulator footprint

- No license number, no way to check the firm on a securities or financial regulator register.

- 💳 Weird payment routes

- Only crypto, gift cards or obscure payment gateways; strong resistance to bank transfers under your own name.

- 🕒 Hard pressure and countdowns

- “This link expires in 30 minutes; reply NOW”, combined with emotional triggers (“don’t miss the next Bitcoin”).

If you see two or more of these in a single pitch, treat it as a red-zone situation.

How to verify a deal in the deepfake era

A. Verify the person

- Cross-check across channels

- Does the same content appear on the influencer’s official website, verified social accounts, or established press coverage?

- If not, assume the “deal” is fake until proven otherwise.

- Look for public denials

- Today, many celebrities and CEOs issue formal warnings when their likeness is abused; a quick search often reveals these.

- Contact via a trusted channel

- For major brands or funds, reach out via official investor relations or customer support, not the link in the video.

B. Verify the platform

- Regulatory check

- Look up the firm on the relevant securities or financial regulator’s website in your country (or where the firm claims to be based).

- Beware firms that claim to be “regulated” in a jurisdiction but don’t appear on any official register.

- Corporate and legal footprint

- Check for a real company number, physical address, and officers that exist in public records.

- Search if the firm has been named in scam alerts, fraud warnings or enforcement actions.

- Provenance and oversight

- For art, watches, cars or whisky: Does the platform provide verifiable provenance, independent valuations, or links to recognized custodians and auction houses?

- For NFTs and digital assets: Can the platform clearly show contract addresses, minting history and ownership logs?

- Human, not just “AI” in the loop

- Serious platforms emphasize human risk committees, compliance teams and curators alongside any AI tools.

- “100% AI-driven trading, zero human oversight” is a marketing slogan for scammers, not a safety feature.

Protecting your own likeness and brand

Deepfakes don’t just steal investors’ cash; they hijack reputations. Legal and policy debates are moving fast, focusing on image rights, intellectual property and new duties for platforms.

For high-visibility collectors, founders and family offices, some practical lines of defense:

- Lock down your official channels

- Maintain a clear list of official domains, handles and emails, visible on your website and profiles.

- Use verification tools where available.

- Contract for your image

- For brand partnerships, insist on clauses limiting how your image and voice can be generated or reused, and who owns the underlying training data.

- Monitoring and takedown playbook

- Use social listening tools or specialized providers to monitor for deepfake misuse.

- Have a standing process: document the fake, file platform takedowns, inform your community, and, where material, notify regulators or law enforcement.

- Personal security basics

- Strong multi-factor authentication on all key accounts.

- Be thoughtful about high-quality video and audio you post; public, high-resolution material is raw fuel for deepfake engines.

The legacy lens: protecting heirs from synthetic personalities

For many I-Invest readers, the bigger risk is not a one-off loss. It’s the slow erosion of a family name and the exploitation of heirs.

Imagine:

- A deepfake of a respected patriarch “endorsing” a dubious token aimed at younger cousins in multiple countries.

- A synthetic “family adviser” that clones the speech patterns of a long-time private banker to pitch an offshore fund.

- Heirs receiving AI-generated WhatsApp voice notes from a “trusted uncle” urging them into a high-risk broker.

To reduce that surface area:

- Create a “trust map” for the family

- List who is authorized to speak about investments on behalf of the family or business, and through which channels.

- Make this visible internally and, where appropriate, to key external partners.

- Teach digital skepticism as a core skill

- Treat deepfake awareness like financial literacy: train the next generation to assume that audio and video can be forged.

- Include simple verification routines in your family office handbook.

- Name a digital executor

- In wills and family governance documents, appoint someone responsible for managing digital reputation, takedowns and platform disputes.

- Align platforms with your governance

- Work with brokers, custodians and marketplaces that recognize family structures and can flag unusual contact patterns or instructions.

For platforms: how to stay investable

Fintechs and marketplaces that get ahead of this risk will be more attractive to affluent investors and regulators alike:

- Adopt content authenticity standards (e.g. watermarking and C2PA-style provenance signals for official media).

- Build deepfake-aware fraud teams, not just generic KYC.

- Offer investor-facing tools – clear scam education, one-click reporting for suspicious videos, and transparent responses to incidents.

- Log and disclose major impersonation events, demonstrating that you treat them as systemic risk, not PR glitches.

In a world where “seeing is believing” has expired, luxury and investment brands that can prove both provenance and human oversight will win trust – and flows.

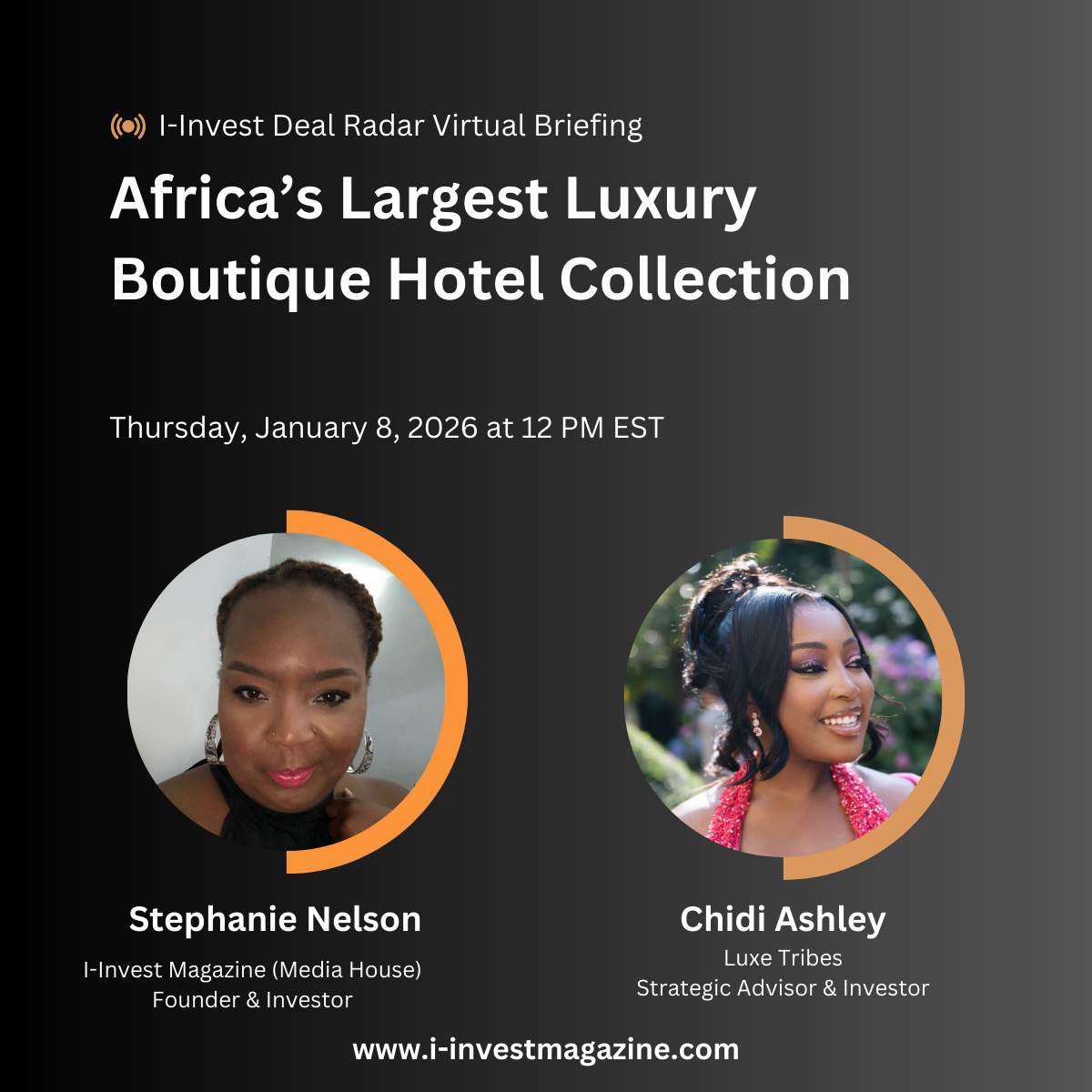

i-Invest DealRadar Virtual Briefing

Come and get information on the next opportunity to invest in a major luxury hotel brand.