When the treaty exists, but the benefit disappears

A holding company receives a dividend from a portfolio operating company.

The treaty says the withholding rate should be 5 percent. The model uses 5 percent. The deal memo cites the treaty. The board approves.

Then the withholding agent applies the full statutory rate. Or the tax authority denies the refund. Or the payer requests additional documentation, and the process stretches into a year.

The reason is often three words: beneficial owner.

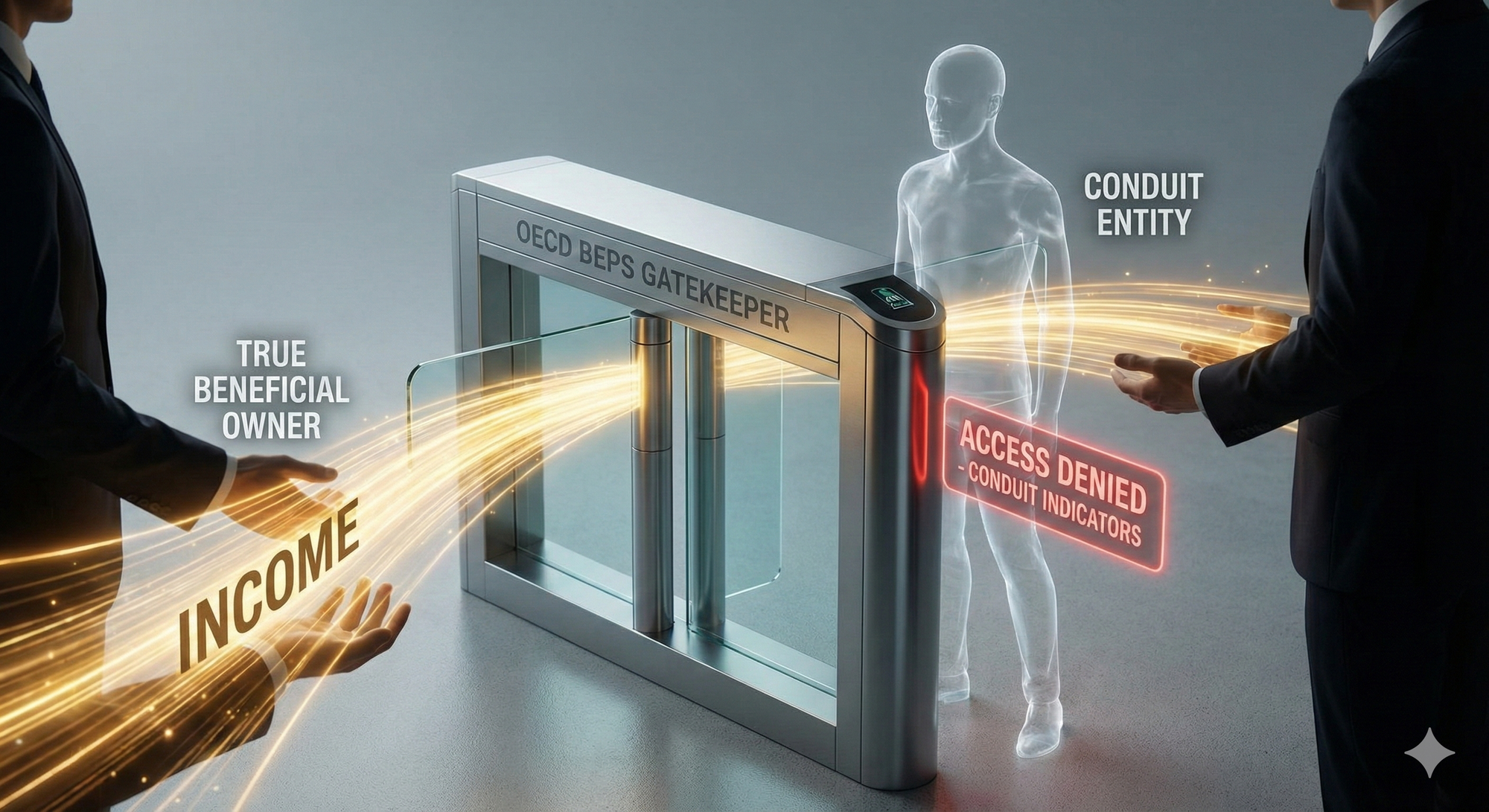

In treaty practice, “beneficial owner” is the gatekeeper concept that aims to prevent treaty benefits from flowing to someone who is not truly the person enjoying and controlling the income. In the OECD Model, beneficial owner language appears in the passive income articles, including dividends and interest, and it becomes a pivot point in disputes.

Now add the BEPS era. Anti-abuse minimum standards exist to prevent the granting of treaty benefits in inappropriate circumstances, including treaty shopping. The multilateral instrument framework exists to implement agreed minimum standards to counter treaty abuse across many treaties more efficiently.

The message to allocators is simple: treaty entitlement is an underwriting item, not an assumption.

MARKET & CAPITAL REALITY CHECK

How beneficial ownership is tested, and why conduit indicators are now priced

Beneficial ownership in plain English

The simplest useful framing is: who has the unconstrained right to use and enjoy the income, and who decides what happens next.

That concept shows up repeatedly in professional explanations of the OECD approach, and it aligns with why authorities look past a paper recipient toward the person who really controls and benefits.

The anti-abuse layer that sits above beneficial ownership

BEPS Action 6 focuses on treaty shopping as a major concern and drives a minimum standard that countries implement via mechanisms such as a principal purpose test or limitation-on-benefits style tools. The multilateral instrument is designed to transpose BEPS results into covered treaties, including measures to counter treaty abuse.

i-Invest DiagnosticOS

From diagnostic to decision-ready in minutes:

Answer a structured assessment, receive your wealth stage and risk signals, then follow a clear, personalized pathway to education, advisory, or diligence.

The court signal that changed behavior in Europe

In the “Danish beneficial ownership” line of cases, the Court of Justice of the European Union addressed abuse concepts and beneficial owner analysis in the context of interest and dividends paid through intermediate EU companies, and it reinforced that EU law protections cannot be relied on for abusive or fraudulent ends. Separately, commentary on subsequent Danish rulings illustrates how withholding tax analysis can turn on whether the intermediate recipient is treated as the beneficial owner versus a conduit.

You do not need to litigate these cases to learn from them. The practical lesson is what banks and authorities now operationalize: if the intermediate entity has no real control, no functions, and money flows straight through, treaty benefits become harder to defend.

Conduit indicators that trigger challenge

- back-to-back payments shortly after receipt

- thin capitalization or no meaningful balance sheet

- no decision-making authority and no real governance artifacts

- no employees or operational function aligned to the income

- contractual obligations to pass the income onward

- mismatch between claimed residence and the real place where decisions occur

These indicators do not prove abuse on their own, but they raise the burden of proof.

THE PLAYBOOK

Build a beneficial ownership file that can survive scrutiny

Who this playbook is for:

- allocators using holding companies, SPVs, or fund structures

- founder-operators with cross-border dividend, interest, or royalty flows

- anyone relying on treaty WHT reduction or refunds

Conditions that need to be true:

- your structure reflects real governance and decision-making

- documentation is consistent across banks, payers, and tax claims

- you can show why the recipient is more than a pass-through

The BO Strength Ladder

Level 1: Weak

- entity exists on paper

- no independent decision-making evidence

- funds flow through quickly with little retained discretion

- minimal or inconsistent documentation

Level 2: Adequate

- clear ownership chain

- signed governance documents and basic minutes

- ability to explain income purpose and uses

- basic beneficial ownership evidence maintained and updated

Level 3: Strong, institutional

- documented decision rights, signatory matrices, and governance cadence

- substance aligned to the income, such as treasury function for interest flows or IP management for royalties

- clear evidence that the entity controls the income and can decide its deployment

- a bank-ready beneficial ownership and control pack that matches the tax story

FATF guidance emphasizes accurate and up-to-date beneficial ownership information and mechanisms to identify and verify it, which is why institutional quality BO packs increasingly align tax defensibility with onboarding durability.

The BO Documentation Checklist

Core folder structure:

- Ownership chain diagram with dates and controlling persons

- Constitutional documents and registers

- Board minutes and resolutions supporting key decisions

- Bank mandates and signatory authorities

- Contracts for income flows, including dividend resolutions, loan agreements, licensing agreements

- Evidence of functions and people, where applicable

- Tax residency certificates and treaty claim forms

- Payment flow map showing whether funds are retained, reinvested, or distributed, and why

Put “conduit risk” into IC memos

Create a one-page checklist:

- Does the recipient have real discretion over the income?

- Are funds obligated to flow onward?

- Are there real functions that justify the income being booked there?

- Does the governance evidence exist and is it current?

- Would a bank compliance reviewer understand the story in one pass?

DEAL & PRODUCT LENS

Why beneficial ownership is now a portfolio constraint

Beneficial ownership weakness creates three portfolio penalties:

- Return drag: treaty rates denied, refunds delayed, statutory withholding applied

- Execution drag: banking and payer friction increases when BO files are incomplete

- Headline drag: disputes look like governance failures, even when the investment thesis is sound

For allocators, the solution is not complexity. It is quality: governance, documentation, and a structure that matches operations.

ACCESS & NEXT MOVES

How to pressure-test BO before you need it

Expert types to involve:

- treaty and withholding litigator or controversy advisor

- corporate governance specialist who can operationalize minutes and decision rights

- bank compliance professional who can test file acceptability

Recommended sequence:

- Inventory every treaty benefit assumption in the portfolio.

- For each, rate BO strength using the ladder.

- Upgrade weak files first, especially where cash flows recur.

- Align the BO file with your WHT documentation pack so payers and banks see one coherent story.

“A treaty is not a shield. It is a contract, and beneficial ownership is the price of entry.”

Key datapoints:

- BEPS Action 6 targets treaty abuse and treaty shopping, and drives a minimum standard to prevent the granting of treaty benefits in inappropriate circumstances.

- The BEPS multilateral instrument is designed to implement agreed minimum standards to counter treaty abuse across covered treaties.

- CJEU case materials and summaries in the Danish line of cases discuss abuse concepts and beneficial owner analysis in interest and dividend routing through intermediates.

- FATF guidance highlights the importance of accurate and up-to-date beneficial ownership information and verification mechanisms, reinforcing why institutional BO files matter.

SOURCES & DISCLOSURE

Key sources used: OECD Model Tax Convention (2017), BEPS Action 6 final report and treaty abuse overview, BEPS multilateral instrument page and convention text, CJEU case materials and professional summaries of Danish beneficial ownership cases, FATF beneficial ownership guidance, UN beneficial ownership background note. (OECD)

Standard I-Invest disclosure: This article is for informational purposes only and does not constitute investment, legal, or tax advice. Seek independent professional advice.