The Audacity Of Quiet Wealth: Why Collectors Win While Spenders Perform

I-Invest Editorial Team

I-Invest Editorial Team

You can hear loud money. It revs outside restaurants. It queues for new phone launches. It shouts through labels and locations.

Quiet wealth does something else. It listens. It accumulates. It chooses what to collect and what to ignore. It lets the numbers, and the life options, speak later.

In an attention hungry economy, choosing to be a collector instead of a performer is an audacious act. It is also one of the most practical, repeatable strategies for building real wealth over the next 5 to 10 years.

The performance economy rewards visible spending. New, shiny, limited, first class. You are applauded for how you look this weekend, not for the assets you quietly bought last month.

It rewards people who systematically accumulate three things over time:

• Productive assets. Investments that can grow or pay you; equities, funds, real estate, businesses, treasury instruments, digital assets with real utility.

• Transferable skills. Capabilities that travel with you across roles and borders; data literacy, communication, strategy, coding, compliance, leadership.

• Meaningful relationships. Networks that open doors; mentors, peers, partners, customers, communities.

A collector is not someone who hoards things, it is someone who curates upside. They are intentional about what they own, what they learn, and who they grow with.

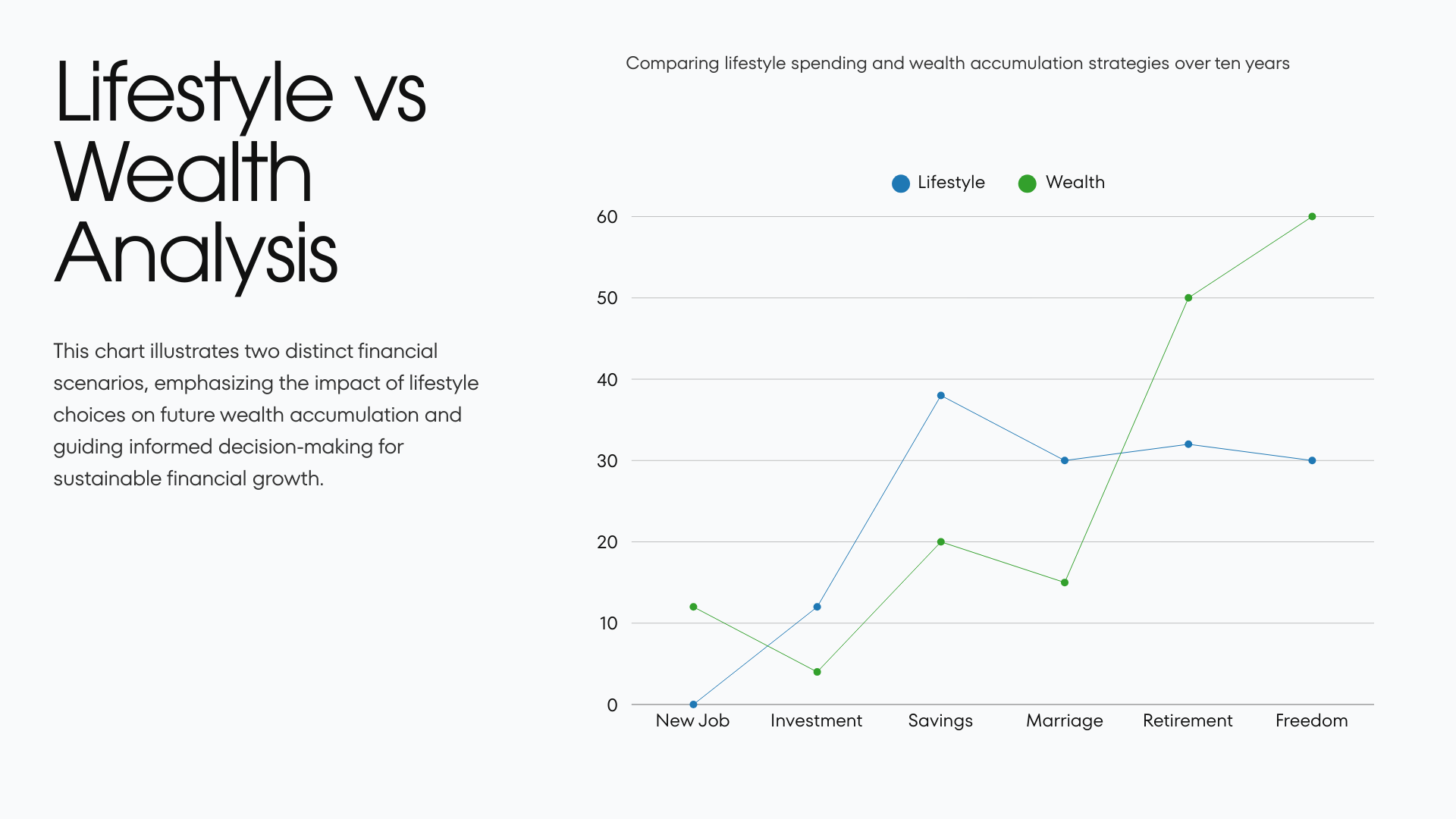

Performers optimize for now. Collectors optimize for next.

The uncomfortable truth is that most people do not lose at wealth because they lack opportunity. They lose because the tiny daily allocations never happen. The cost of one lifestyle choice here, one upgrade there, quietly removes the capital that could have been collected.

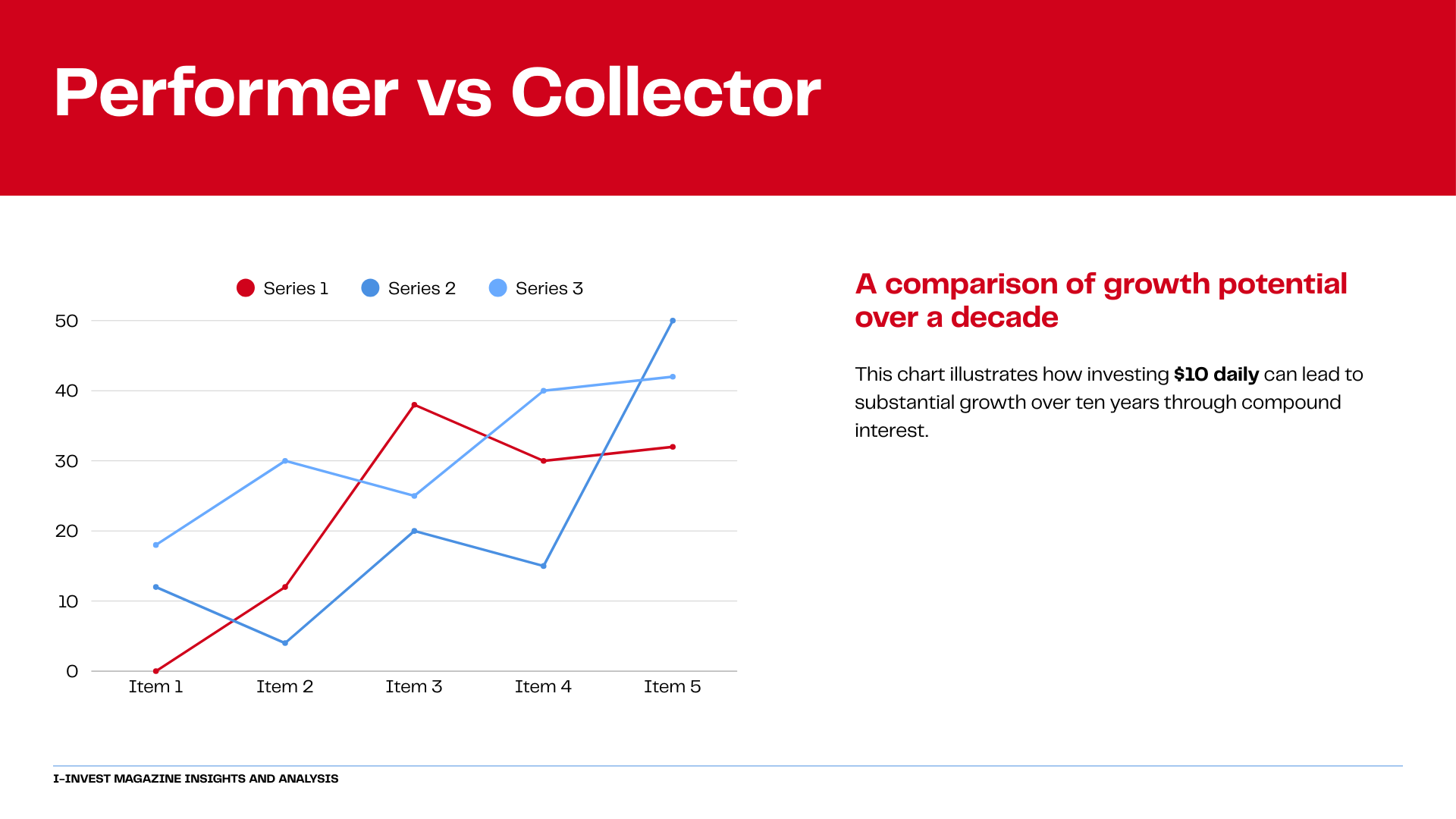

Imagine two professionals, both earning the same income, both coffee in hand.

The performer spends an extra 10 to 15 dollars (or equivalent) a day across small flexes; upgraded rides, impulsive deliveries, quiet lifestyle inflation.

The collector diverts the same 10 to 15 into productive assets, every weekday, for years.

It is not the exact numbers that matter. It is the principle: micro, boring contributions, sustained over a decade, can easily cross into six figure territory in many currencies. The performer feels richer in year one. The collector feels infinitely freer in year ten.

The compounding of skills works the same way. One online course every quarter, one stretch project per year, one uncomfortable but strategic conversation each month, compounded over a decade, creates a completely different career asset.

Quiet wealth also compacts in your network. There is nothing glamorous about consistent, thoughtful contact. Sending a note when someone changes roles. Showing up prepared to industry events. Making one useful introduction a month.

By year ten, a collector who acts consistently has a living system around them; people who can unlock jobs, deals, capital, visas, new markets. None of that looks exciting on social media. All of it is transformative in real life.

This is what we mean at I-Invest when we connect thought leadership to humanity. Wealth is not just a portfolio chart. It is the quiet confidence of knowing that you have options when your industry shifts, your country changes policy, or your family needs something bigger from you.

Audacity is often portrayed as big, noisy bets. Quitting everything. Going all in. Making a headline move. In practice, the boldness that works for most people looks different.

Audacity is:

• Saying no to lifestyle inflation when your income grows, and treating the difference as capital to collect.

• Accepting that you might look “less successful” than your peers for a while, while you allocate to assets, skills, and relationships.

• Choosing long term resilience over short term validation.

It takes real courage to be the one who does not always upgrade. To hold the older car, the simpler apartment, the non designer wardrobe, while you upgrade your balance sheet and your earning power instead. That is quiet audacity.

From a distance, Line A looks like success for the first few years. After a decade, Line B is the person with options; the ability to relocate, to take a sabbatical, to fund a venture, to care for others without panic.

Within the Coffee & Collectors lens, a collector is defined less by what they have today, and more by how they behave every month.

• Allocates on purpose. Even small amounts are tagged; “this is for future me”. Automations are set; emotion is reduced.

• Chooses learning like an asset. Courses, certifications, new tools, industry understanding; all treated as part of a personal portfolio.

• Nurtures a living network. Not transactional, not performative; genuine value exchange over time.

• Measures progress in years, not weekends. Five to ten year arcs, not five to ten day trends.

You can be a collector on a modest income. You can be a performer on a high one. The difference is philosophy, not pay grade.

Quiet wealth is not just about beating inflation or “winning” a money game. It is about dignity. Being able to say yes or no from a place of stability. Being able to support parents, children, partners, and communities without destroying yourself. Having the buffer to leave toxic environments, whether personal or professional.

This is why the Coffee & Collectors segment sits inside Audacity. It is audacious, in many of our markets, to:

• Think beyond survival and begin to curate a real financial future.

• Believe that you deserve more than constant hustle and anxiety.

• Refuse to let social pressure dictate your spending story.

Thought leadership that ignores this human layer is incomplete. At I-Invest we are not just interested in which fund performs. We are interested in who you can become if you choose to live as a collector.

The shift does not need drama. It needs decision. For a reader sipping coffee and feeling that quiet friction, here is a simple pivot plan that respects both ambition and humanity:

Year 1: Awareness and automation

Track where your money actually goes, across lifestyle and flex. Carve out a realistic percentage, even 5 to 10 percent, and automate it into basic, diversified assets.

Year 2: Skill acceleration

Pick one core skill that will raise your earning power. Commit to structured learning and visible application. Treat course fees as an investment ticket, not an expense.

Year 3: Network strategy

Audit your relationships. Join at least one community that aligns with your next decade, not your last one. Schedule small, consistent touch points.

Year 4: Portfolio refinement

Upgrade from basic to more intentional. Rebalance, diversify across asset classes, consider cross border options if appropriate to your situation, seek qualified advice.

Year 5: Optionality design

Translate your collected assets, skills, and relationships into real options. Could you relocate. Change roles. Start a venture. Take a break. Support a cause. Build a plan around one or two of these.

Across this timeline, you will still have coffees, celebrations, small flexes. Quiet wealth is not about deprivation. It is about direction.

Build a collectors manual and become savvy in building collecting and disseminating your wealth. Find out where you are in the continuum and become the most informed collector in the market.

In the end, the spender performs for today’s audience. The collector performs for tomorrow’s life.

The audacity of quiet wealth is choosing to be impressive to your future self, even if that means being less impressive to the current crowd. Cup in hand, that is the question in front of every reader; who are you really collecting for?